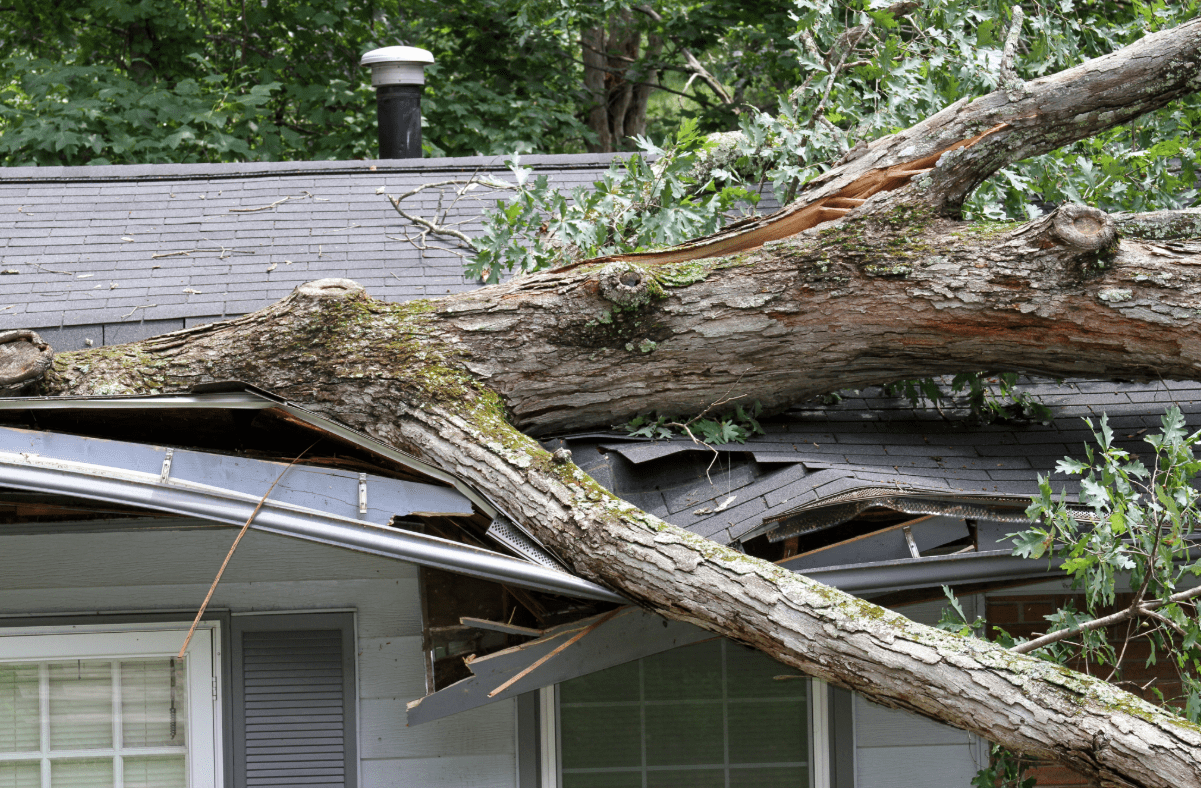

What Is The Process For A Home Insurance Claim?

Knowing how and when life will return to normal helps give you peace of mind when an unexpected loss occurs.

Check out this general guide to the home insurance claims process, so you can understand what to expect if you have to file a home claim.

Home Claim

File a claim

For many carriers you can file a claim online through a mobile app in as little as ten minutes.

- Water damage? Your carrier may assign a certified water mitigation vendor to come dry out your home to prevent further damage.

- Home uninhabitable? Your carrier may be able to help you arrange and pay for temporary housing while your home gets repaired.

Claim investigated

- Minor damage? In many cases, your carrier will have you take and submit photos of the damage using your smartphone.

- Severe damage or total loss? A claims representative will schedule a time to discuss the damage and a plan for supporting your needs during the rebuilding process.

Damage assessed

- For exterior hail or wind damage, a your carrier may have a preferred network of repair providers that can estimate and complete repairs and bill your carrier directly. For other damage types, your claims representative may refer you to preferred contractor.

- Have your own contractor in mind? Your carrier will typically provide you an authorized estimate of what the carrier is paying to complete the repairs.

Home repaired

Your contractor will work with your carrier to secure approval for payment before repairing any additional damage it finds while repairing your home.

Get paid

Your carrier will issue payment after approving the estimate for repairs to your home. You can receive payment in minutes electronically or by check.

Quick Quote Form

Categories: Blog

Tags: Home Insurance